SERVICES • ITIN

Let experts get you an ITIN fast.

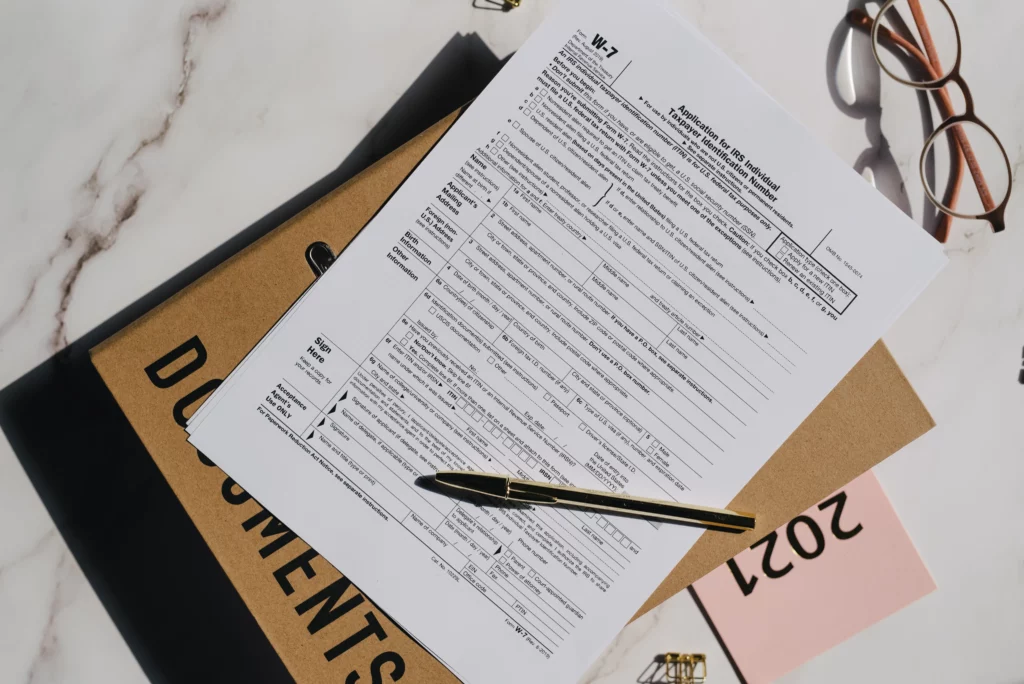

About the $400 ITIN Filing Service

Foreign US business owners, nonresident investors, and individuals who need to file US taxes and comply with financial regulations must get an ITIN. An ITIN is a unique tax identification number issued by the IRS to individuals. We will help you get an ITIN by submitting the application the the IRS on your behalf.

What Is an ITIN?

An ITIN is a unique tax identification number issued by the IRS for individuals who are not eligible for a Social Security Number (SSN). It is required to file US taxes or comply with financial regulations, and often the ITIN opens the same doors as a SSN.

Why Do You Need an ITIN?

With an ITIN, you can:

-

File state and federal tax returns as required by the IRS

-

Open a personal US bank account

-

Apply for credit cards and build a US credit score

-

Qualify for better mortgage options for real estate investments

-

Access US payment systems for business transactions

-

Open a US PayPal and Stripe account for easier online payments

-

Utilize tax deductions and benefits as a real estate investor

NONRESIDENT INVESTOR

How We Help You Get Your ITIN

The Nonresident Investor team specializes in ITIN applications for foreign business owners and investors. As an IRS-certified partner, we streamline the process, ensuring accuracy and efficiency.

To obtain an ITIN, you must:

- Fill out Form W-7 (Application for IRS Individual Taxpayer Identification Number).

- Provide proof of foreign status and identity (passport or other government-issued ID).

- Submit the application through an IRS-authorized acceptance agent.

Our Process

-

Step 1.

We complete and review Form W-7 for accuracy. -

Step 2.

We guide you in gathering the required supporting documents. -

Step 3.

We submit your application through IRS-certified acceptance agents. -

Step 4.

We track the status and ensure your ITIN is issued as quickly as possible.

What You Can Do With Your ITIN

Once we secure your EIN, you can:

-

File US tax returns to stay compliant with IRS regulations.

-

Open personal US bank accounts for better financial flexibility.

-

Apply for credit cards to start building a personal US credit history.

-

Access better loan and mortgage options for your investments.

-

Receive rental income legally and efficiently.

-

Open a personal US PayPal and Stripe account.

Our trusted ITIN filing service ensures a hassle-free experience so you can focus on your investments.

*Disclaimer: An ITIN is not the same as Social Security Number. It does not give you legal permission to work in the US.

Get Started Today

ITIN Filing Service – $400

-

Professional ITIN filing for nonresident investors

-

IRS-certified acceptance agent process

-

Quick and reliable service

One-Stop Solution for Foreign Entrepreneurs Doing Business with the US

Nonresident Investor offers a complete range of services for international investors and business owners conducting business with the US:

-

US Mortgages

-

Company Formation

-

Offshore Tax Planning

-

US Tax Filings

Our team of experts provides tailored solutions to help you navigate the complexities of doing business in the US, ensuring compliance and maximizing financial benefits.