Do you want to take a bite out of that delicious US Real Estate market pie? If you do, you’re not alone. Maybe you’re looking to diversify your investment portfolio, and the US market seems like an excellent way to start. (You’re not wrong, by the way.) If that’s the case, you must wonder: “Can foreigners buy US real estate?”

Or, perhaps, you want to make a cozy retirement plan in the form of a property in a stable, economically powerful country where you’ll be able to live out your retirement years. Alternatively, maybe you’ve decided that your dreams of having a passive income should finally come true.

Either way, no matter which of those is true, you’ve probably wondered can foreigners buy US real estate. After all, the US Real Estate market is one of the strongest in the world. Who wouldn’t want to own property there?

But the question of the day is: can foreigners buy US real estate? Can foreign nationals even buy Real Estate in the US, or should you immediately start looking elsewhere?

The great news is that, YES, you can.

However, keep in mind that purchasing real property in the US isn’t a marathon you’ll be able to run smoothly. The US Real Estate market is open, meaning everyone, even foreign buyers, is welcome to buy pretty much any property. Check out the foreign investing statistics in USA real estate.

Foreign investors can buy a house or a condo and even invest in commercial real estate. They can also buy into a housing cooperative (although that comes with a few extra layers of complications due to potential stipulations from homeowners’ associations and other community associations).

But buying residential real estate as a citizen and as a foreign investor are two completely different scenarios.

An Open, Welcoming Market

The only real barrier residents and nonresident aliens (or non-citizens) have when buying property is when it comes to buying agricultural land in some states (such as Minnesota, Hawaii, North Dakota, Mississippi, Iowa, and Oklahoma).

So, unless you’re looking to become a farmland owner in one of these six states, you can buy pretty much any type of real estate you want (and can afford). Of course, the real trick is:

- Navigating the real estate market (getting a real estate agent isn’t enough);

- Working through the red tape;

- Figuring out what you, as a nonresident, have to do in terms of bureaucracy;

- Securing financing (that’s a bit more difficult to acquire for nonresident aliens);

- Figuring out your tax rate and paying property taxes.

Of course, these are just some of the steps of a long and complicated process: buying Real Estate in the US.

Can Foreigners Buy US Real Estate? Yes, And The Time Is Now!

The US Real Estate market is liberal, which is fairly evident when you look at the numbers. Even though housing prices have soared over the past year (and more), the housing market is proving to be quite resilient.

During the pandemic, more than 60% of all homes sold in the US were sold above the asking price. Dubbed the “race for space,” this phenomenon was easy to explain. People were racing to secure housing in unprecedented times when workspace and living space collided into one. That’s why we saw thousands of people relocating from massive metropolitan areas to other, more affordable cities and states.

However, now that the global situation regarding the pandemic has been somewhat stabilized, the housing market in the States has returned to a “new normal.” For reference, the total size of the housing market doubled in the past ten years. But today, it’s showing signs of slowing down or cooling. That means that now is the perfect time to invest in real estate.

Of course, many people have figured that out. The US has:

- World-class infrastructure;

- A stable economy and political environment;

- Other benefits such as a welcoming and tolerant social climate;

- Access to some of the most authoritative educational institutions in the world;

- And many more benefits that we’ll talk about in later chapters.

That’s why many people, not just US citizens and resident visa-holders, are looking to get into the housing market.

Can Foreigners Buy US Real Estate, And Who’s Investing in the US Real Estate Market?

Foreign investors or nonresident investors are slowly but surely returning to the US Real Estate market. Just before the pandemic hit (as well as during the height of COVID), nonresidents’ share in the housing market was on the decline. However, there’s been a steady increase in the number of existing homes purchased by nonresidents (8.5% compared to the previous three years).

Between April 2021 and March 2022, nonresident investors purchased $59 billion worth of property in the States. They bought more than 96,000 homes, which represents around 1.6% of the 6.06 million homes sold in that period. That’s quite an increase compared to the previous year when foreigners bought $54.4 billion worth of properties.

- Recent resident aliens (foreigners on a visa) bought around $34.1 billion worth of property (5.2% more than the previous year);

- Resident aliens represent around 58% of the dollar volume of all home purchases within the previous year;

- Nonresident investors bought $24.9 billion worth of existing homes which adds up to around 42% of the dollar value;

- Nonresident investors bought around 13.2% more homes and residential real estate than the previous year;

- Overall, foreign nationals account for 2.6% of the entire existing-home real estate market, which is worth more than $2.3 trillion.

Can Foreigners Buy US Real Estate, and What Is Their Buying Power?

According to the NAR (National Association of Realtors), we’re currently experiencing an all-time high regarding foreign nationals’ buying power. When it comes to existing-home sales, foreign investors paid, on average, $598,200 for a residential property, while the median price was $366,100. That is an increase of 17.7% compared to last year when it comes to the average price and 4.1% when it comes to the median one.

Of course, we can’t disregard the fact that home prices, in general, went up during the previous year. For example, the median price of a home was 8-10% higher in August of 2022 than it was in the same month of the previous year. However, the increase in how much foreign nationals spend for a home in the US has undoubtedly gone up, regardless of the current pricing on the market.

It’s also worth noting that international buyers tend to purchase property with cash. 44% of all foreign buyer transactions were done without any financing. That’s quite impressive, considering that only 24% of resident transactions for existing homes were all-cash.

Furthermore, 60% of all those international transactions were made by nonresident buyers. So, what does that mean? It means that nonresidents tend not to dilly-dally and search for financing; they prefer to do things the easy way (and pay with cash).

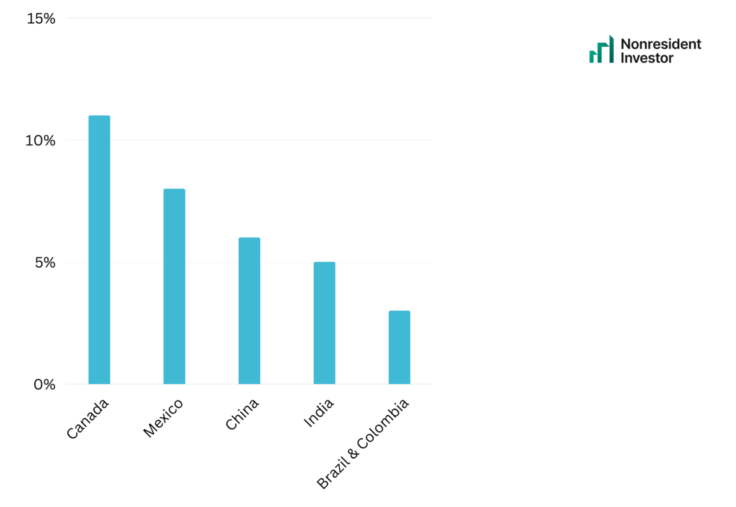

Can Foreigners Buy US Real Estate And What Is The Most Common Nation?

Pretty much anyone is welcome to participate in the open real estate market in the US. However, there are a few countries that take the lead when it comes to their citizens being ready and able to buy property in the States.

- Canadian citizens are among the top nonresident buyers. They make up 11% of all foreign buyers and have bought $5.5 billion worth of properties in the previous year. 69% of those were all-cash buys (you can read our Canadian Buying House in the USA guide);

- Next is Mexico, with $2.9 billion worth of property, making up for 8% of all foreign buyers. 27% of all Mexican residents that buy property in the US do so in cash;

- China is close behind with 6% of all nonresident purchases. Chinese citizens spent around $6.1 billion to buy residential property in the States in the previous year, and 6 out of 10 of them did it with all-cash transactions;

- Indian citizens are next on the list, given that they contributed $3.6 billion and make up 5% of the foreign buyers market. However, they are also least likely to pay with cash, as only 9% of them did this previous year;

- Finally, Brazil and Colombia also fall into the top five countries, with 3% of the market share and $1.6 and $1 billion, respectively. Similar to Mexicans, Brazilians also like to settle their business with all-cash transactions, given that 2% of them do just that.

If you don’t see your country on this list, don’t let that discourage you. After all, I hail from the small (but mighty) Montenegro, and I managed to buy residential properties in the US.

The point is that not only is it possible, but it’s also quite common for nonresidents to purchase property in the States. As mentioned, foreign investments make up 2.6% of all existing-home purchases in the US. That’s not a small number!

What’s more, you CAN be a part of the following year’s 2.6 (or more) percent. All you have to do is play your cards right and consult the right people (I learned that the hard way).

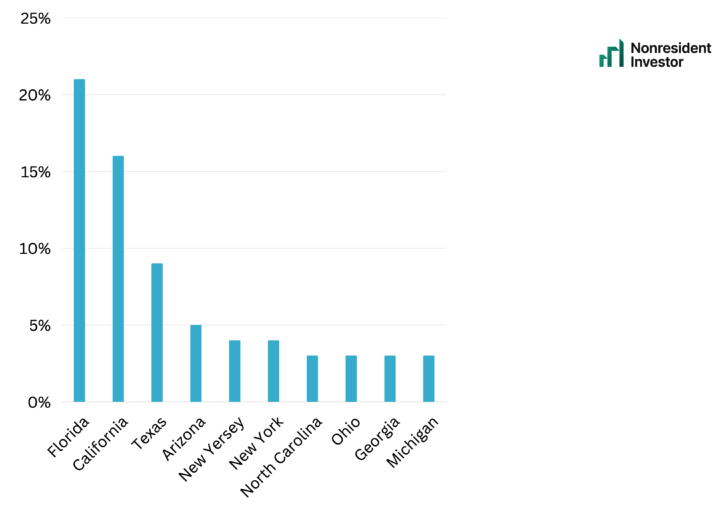

Which US States And Cities Are the Most Popular With Foreign Investors

When you’re buying property in the States, the entire country is your oyster, so to speak. In other words, there are really no restrictions when it comes to where you want to settle and invest. I personally chose Milwaukee when I made my first investment as a nonresident, but you can pick any state and city you want.

Of course, doing some due diligence beforehand is a smart move.

On average, most nonresident investors pick Florida. In fact, they’ve been doing that for the past 14 years. For almost a decade and a half, Florida has topped all charts when it comes to being a safe haven for foreign investors. Besides that, moving to Florida from Canada is very common.

Although the most popular, Florida isn’t the only state that seems to be appealing to nonresident investors. Here’s a list of the top ten, along with their intake:

- Florida — 21%

- California — 16%

- Texas — 9%

- Arizona — 5%

- New Jersey — 4%

- New York — 4%

- North Carolina — 3%

- Ohio — 3%

- Georgia — 3%

- Michigan — 3%

Why Opt for Investing in the US Real Estate Market?

There’s no doubt that real estate is a great investment. However, not every real estate market is equally good. You’ll agree that there’s quite a difference between buying a house in the US. and in, let’s say Venezuela.

But why is the US Real Estate market such a great investment opportunity?

First of all, you should invest in the US because you can. There are no barriers for you (even if you’re not an all-cash buyer). But that’s not all.

The US Has a Stable, Strong Economy

Investing in a country that has a strong economy means your investment won’t devalue with time. Sure, there are things that could happen that could potentially ruin the value of your property. However, objectively, a strong economy like the one the US has is a surefire sign that your investment will be safe.

Furthermore, your assets in the States will also be safer from asset forfeiture. The US government, of course, reserves the right to seize property for this reason or another. However, unlike some other countries, the US is somewhat cautious when it comes to making moves like these. In fact, the government often makes them only if they benefit the larger public.

Therefore, your future assets in the States will be relatively more secure than elsewhere in the world, given the stability of the housing market and the lack of government limitations.

Finally, if we’re being honest here, investing in the US Real Estate market is a baller move. The US is a brand in and of itself, and it’s a brand a lot of people want to be a part of. That has a lot to do with the social and economic climate in the country.

The US is a land of opportunity. It’s where people come to live the American dream (that’s still alive and well, no matter what the naysayers say). A socially free and capital-driven country, the US has an open market that is a safe haven for all nonresident investors.

Competitive Property Prices And Capital Appreciation

One of the strongest incentives for investing in the US Real Estate market is capital appreciation. Because the housing market is so competitive in the US and quick to follow the changes in the world’s economy, you can reasonably expect a high capital appreciation.

Because there’s the already mentioned race for space all over the States, you can expect that residential (buying and renting) prices will continue to go up in the next few years. Therefore, your property won’t ever lose its value. In fact, you can expect a steady passive income from it or to turn a profit if you sell it in the next couple of years to a decade.

An Opportunity for Passive Income

If you’re primarily interested in buying property in the US to rent it out and get some passive income into your pocket, you’re not the only one. Thanks to the current rental market, this is an excellent move for all investors.

Unlike the housing market, which has its ups and downs, the rental market has been steadily growing for the past couple of decades. And, if there’s something we can all rely on in life, it’s the rental market not stopping its growth.

- The rental market is worth over $229.1 billion;

- It has been steadily growing (it has gone up 1% since 2017);

- The rents keep going up (on average, in the first half of the year, rents have gone up by 12% for new tenants and 3.5% for old tenants);

- The average rent in the US has gone up by more than 50% since 2008;

- The number of renter households increased from 43 to 44 million in 2021;

- Meanwhile, vacancy rates fell from 6.6% to 5.8%;

Therefore, it’s clear that the rental market is a vast and competitive one, with plenty of opportunities for property owners. It’s now easier than ever to rent out your property to trustworthy, reliable tenants because all you really have to do is say you have a place available for rent and watch the applications roll in.

The law of supply and demand is as clear here as it is when it comes to the housing market. The demand is there. And because there’s high demand, the prices will continue to soar.

For Those Who Can Take It

Now, this can be beneficial to you as a prospective property owner. But it can also be a cautionary tale. Don’t waste a lot of time waiting.

Buying a property in the US is a lengthy process if you’re a nonresident. However, it’s not an impossible task. So, now is the time to grab the bull by the horns, so to speak, and invest in the US Real Estate market. With the demand at an all-time high, especially for rental properties, you can expect a high passive income and capital appreciation.

The Double Benefit of Investing in the US Currency

The dollar has always been one of the strongest currencies in the world. Lately, thanks to the unsavuory world events, it’s gotten even stronger. When you invest in the US Real Estate market, you’re also passively investing in the US currency.

If you were to buy a house in the country you live in, you’d be investing in your national currency. Although that’s not a bad way to go, you’d be putting all your eggs in one basket. And as we know, currencies are fickle beasts.

Currently, the dollar is on the rise. Taking advantage of that is a great idea.

Let’s say you open an LLC as a foreigner in Florida and buy a house in Florida right now. The typical price for a single-family home in Florida is around $406,988, with an expected yearly value change of up to 27%. Now, if you were to buy that house today, you’d have paid for it 27% less than you would next year. Therefore, if you were to sell it next year, thanks to the constant rise in housing prices, you’d get more money for it than you paid.

However, because the dollar will probably continue its steady rise, you’ll turn an even bigger profit because investing in real estate also means passive investments into the currency.

And that’s just the profit or cash flow you can expect if you sell the property. If you buy a house in order to rent it and get some passive income into your pocket, thanks to the currency appreciation, you can expect a higher profit than you would not that long ago.

Therefore, investing in the US Real Estate market offers a double benefit, given that you’re investing both in the real estate and the currency.

Ideal Vacation Homes And Retirement Plans

Not everyone is interested in investing in the US because it’s a great way to diversify your portfolio. Although that’s undoubtedly true, buying residential properties in the US can also be a great way for you to secure future housing for yourself or your loved ones.

Around 44% of nonresident buyers purchased a property in the States to use as a vacation home. A high number of them also buy property in order to secure housing for themselves in their twilight years. Plenty of people choose the US as their ideal retirement spot.

Furthermore, a lot of nonresident buyers purchase properties as a way to secure their children’s futures as well. As mentioned, the US is home to some of the most reputable universities and colleges. A lot of college-aged kids dream of studying there, which is what motivates plenty of nonresident buyers to bite the bullet and purchase a property somewhere in the States. After all, it’s a better investment than renting out something for your kid for four to six years.