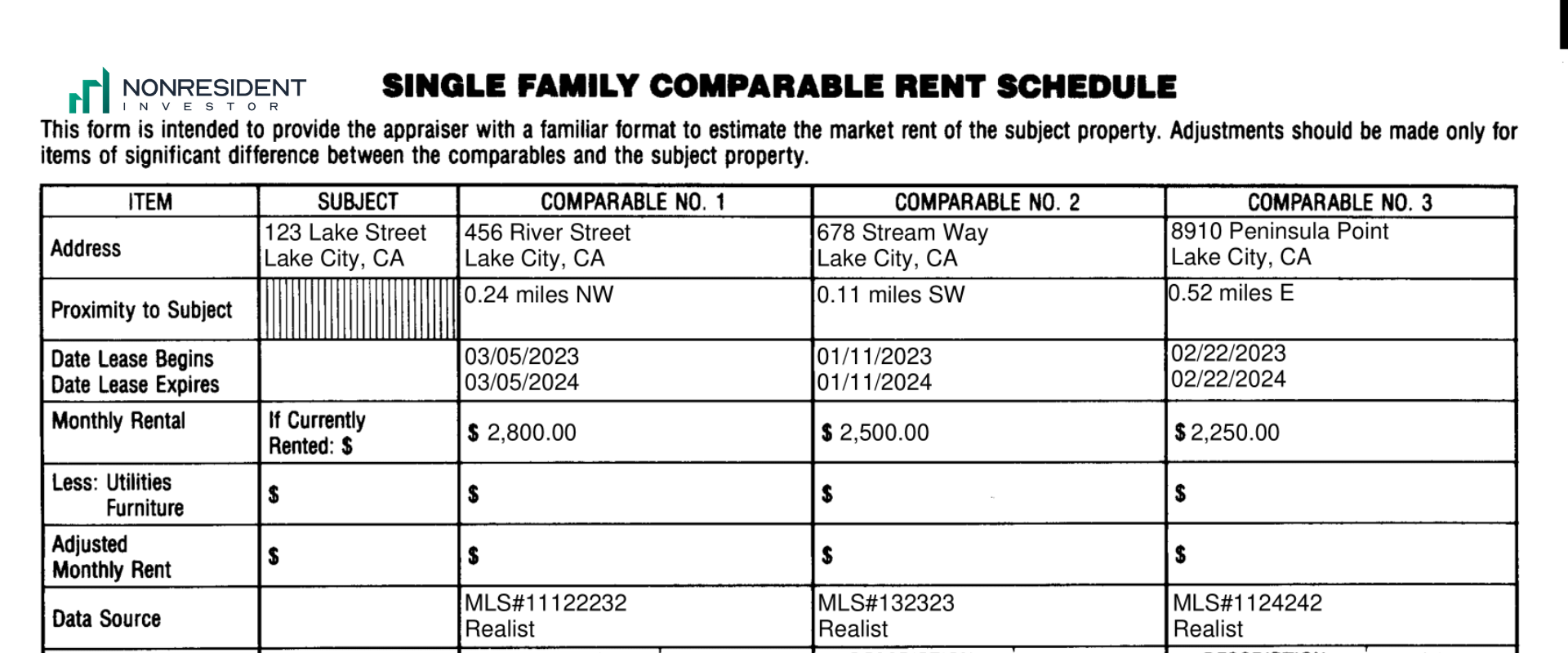

In the world of real estate, evaluating properties and their rent schedule (or potential rental income) are two of the most important processes. They are used to help investors make the most informed decisions possible. The process of evaluation can significantly mitigate risk and allow for a deeper insight into a specific property’s worth and the potential income it can generate. And, one of the most common ways to evaluate property rental income is with a form 1007.

What Is a Form 1007?

A 1007 appraisal form allows professional appraisers to ascertain the current rental value or rental potential of a specific single-family property. To do this, residential appraisers will analyze the main property and compare it with at least 3 other similar properties, based on:

- The physical condition of the property;

- Size of the property;

- Property type;

- Location;

- Lease agreements;

- Number of rooms;

- Gross living area;

- Year of construction;

- Rent amount for comparable properties;

- Adjustments for differences between the subject property and the comparables.

A Form 1007 is solely used for single-family rental properties. Meaning, that the 1007 appraisal form it’s not applicable to any other type of property, such as commercial, condominiums, apartment buildings, etc.

source: realvals.com

source: realvals.com

What Is a 1007 Form Used For?

The main use of the 1007 Form is to give mortgage lenders enough information about the specific property, so they can determine (with a higher degree of accuracy) whether or not to approve or deny a borrower’s request for a loan.

There are different types of mortgage loans that rely on 1007 appraisal forms, including:

- DSCR loans;

- Portfolio loans;

- Private loans;

- No-Doc Mortgage Loans;

Who Uses the Form 1007?

The form 1007 is mainly used by:

- Property appraisers — They use the form 1007 to estimate potential rental income that a single-family home can bring in.

- Lenders — Lenders use the potential rental income estimate of form 1007 to calculate the debt-to-income ratio (DTI) or DSCR score. These numbers are there to help lenders determine whether or not a specific property generates enough income to cover the debt, and the loan amount borrowers can afford.

- Investors — Investors use the potential rental income to estimate whether or not investing in a particular property will be the right investment decision for them.

- Real estate agents — They use the information from form 1007 to help their clients determine the amount of rent tenants should be paying

Form 1007: Examples of Use

Here are a couple of examples of some of the most common ways and situations in form 1007 is used:

- Homeowners looking for mortgage refinancing — The lender will require it to estimate the fair market rent of the home and to determine the borrower’s DTI or DSCR score.

- Investors looking to buy a single-family home to rent out — They will use this form to evaluate the potential rental income of a specific property in order to make an informed investment decision.

- Real estate agents listing a single-family home for rent — They will use 1007 form to help homeowners ascertain the monthly rent of a particular property.

What Is the Rent Schedule?

A rent schedule is a document that details potential rental rates for a specific rental property. The rent schedule can be determined by the owner, property manager, or licensed appraiser. The rent schedule is based on different factors, including:

- Expenses;

- Supply and demand;

- Local and federal regulations;

- Property condition;

- etc.

1007 Appraisal Form — DSCR Requirements

One of the key roles of Form 1007 is to help potential investors (and mortgage lenders) determine the DSCR value of a specific property. As we’ve mentioned earlier, 1007 forms are used to evaluate the rental potential of a specific property, or simply – the amount of money tenants will have to pay each month.

Once the rental appraisal is over, both lenders and borrowers will have the rental potential number (rent schedule, or monthly rental amount) that they can use to calculate the DSCR of a specific property.

And, why is DSCR important?

Based on it, (or more specifically how high it is), DSCR loan lenders will decide whether to

approve or deny mortgage applications. Usually, lenders will be looking for a DSCR score of at least 1, but a lot of them won’t settle for a DSCR score of less than 1,25.

How Does Rent Affect Property Value?

There are many different factors that can have an impact on the value of a specific property, including:

- Location;

- Current or predicted market conditions;

- Global and national economy;

- Federal and state regulations;

- Rental income or rental yield;

Rental income (also called rental yield) is one of the most direct factors that can influence the value of a particular rental property. The exact or potential rent amount (rent schedule) a property can generate is directly correlated to the market price of a certain rental property. The higher the rent is, the more valuable the property will be.

FAQ

What is a single-family home?

A single-family home (SFH) is a type of residential property specifically designed to accommodate a single family. Single-family homes are located in all types of areas, including suburban, urban, and rural areas.

What are the main differences between form 1007 and 1025?

Form 1007 and Form 1025 are appraisal forms that are commonly used in the real estate business. The main differences between these two forms include:

- Form 1007 is used for single-family homes (or single-unit properties). On the other hand, the 1025 appraisal form is used for small, 2-4 unit properties (duplex, triplex, fourplex).

- Form 1007 is mostly centered around appraising the rental data of a single-family home, while 1025 takes into account both rental income and fair market value of the types of properties it’s used to evaluate.