If you’re a foreigner starting an online business and need a safe and reliable method of processing international payments, having a US PayPal account can come a long way. However, when opening one, nonresidents have additional requirements to meet than US citizens.

In this article, we will teach you how to open a US PayPal account as a foreigner from any country in the world. Whether you need one for your e-commerce website or just want an easy-to-use international payment system, we’ll guide you through the entire process.

But first, let’s quickly cover why foreigners want a US PayPal account so often.

Why Would You Want to Open a US PayPal Account as a Foreigner

Today, we live in a world without boundaries. The internet lets nearly anyone start a business and sell a product or service online, even if you come from a country with limited access to online payment options. However, that wouldn’t be possible without online payment services like PayPal.

Whether you’re building a dropshipping business, outsourcing IT services, selling products online, or want to live a life as a digital nomad, PayPal allows you to send and receive money from clients anywhere in the world.

Although you can open a PayPal account in over 200 countries, not all accounts are equal. In fact, a US PayPal account is by far superior to all others. And there are several reasons:

- US PayPal accounts operate in USD, which is one of the most stable currencies in the world;

- American PayPal users pay lower fees;

- A US PayPal account makes doing business on American soil much smoother and easier (due to processing payments in America’s native currency);

- An American PayPal account has no limits (like in some other countries) and allows you to process payments from anywhere.

Although you could do business with most PayPal accounts, the American account has too many upsides to ignore. So, if you can, always open a US PayPal account when doing business internationally.

Why Choose PayPal Instead of Another Online Payment Service?

It’s true that there are many other online financial services like PayPal that nonresidents can use to get paid online regardless of where they live (e.g., Wise, Mercury, Payoneer). These providers offer excellent security, are easy to use, and allow fast transactions worldwide. However, PayPal has one key advantage — it’s supported globally.

Although these financial providers are excellent choices for foreigners building a global business in the US, many countries won’t have access to them. PayPal, on the other hand, is available in over 200 countries worldwide, making it one of the most universally used payment systems in the world.

Still, if you choose to go with another payment provider, just ensure it is supported in the countries you plan to do business in.

Should You Open a Private or a Business PayPal Account?

If you’re doing business internationally, you’ll want to open a business PayPal account. The primary reason is that you won’t be able to open a private PayPal account without a Social Security Number (and you likely won’t have one). However, you can open a business PayPal account with an ITIN (which you CAN get). On top of that, there are two other benefits of having a business PayPal account instead of a private one:

- It gives you access to PayPal’s API;

- You can easily integrate PayPal with your e-commerce webshop, Calendly, or even your Upwork profile in just a few clicks.

The above makes PayPal one of the most user-friendly payment options for non-tech-savvy people while allowing for custom implementations for seasoned coders.

What You Need to Open a US PayPal Account as a Foreigner

To open a PayPal account for your business, you’ll need the following:

- Proof of LLC formation;

- A company phone number and address;

- An Employer Identification Number (EIN);

- An ITIN or SSN.

When you open a US LLC as a foreigner, you will get all the above except a Social Security Number (SSN). However, you can use an ITIN to create your PayPal account instead.

NOTE: If you don’t have a US LLC yet, you must open one before creating your PayPal account. We have a step-by-step guide to teach you how to do that here.

What’s an ITIN?

An Individual Taxpayer Identification Number (ITIN) is a nine-digit number used for tax processing purposes given to nonresidents who aren’t eligible to receive an SSN. The ITIN is inferior to an SSN in many aspects, particularly in that it doesn’t authorize you to work in the US and receive various governmental and social benefits that US residents have.

How to Get an ITIN?

Before they can apply for an ITIN, foreigners will need to meet two conditions:

- Have a valid reason for needing a way to file taxes in the US (e.g., having a US-based LLC, being married to a US citizen);

- Having the status of a nonresident alien (you earn that by submitting the 1040 NR form).

If you meet the above conditions, you can apply for an ITIN by filing Form W-7 with the IRS alongside your proof of nonresident alien status and identity (government-issued ID or driver’s license).

Once you get an ITIN as a nonresident, you can use it instead of an SSN to open your US PayPal account.

How to Open a US PayPal Account as a Foreigner for Your Business

Once you have all the necessary documentation, you’re ready to create your business PayPal account with an ITIN. Here’s how you should do it:

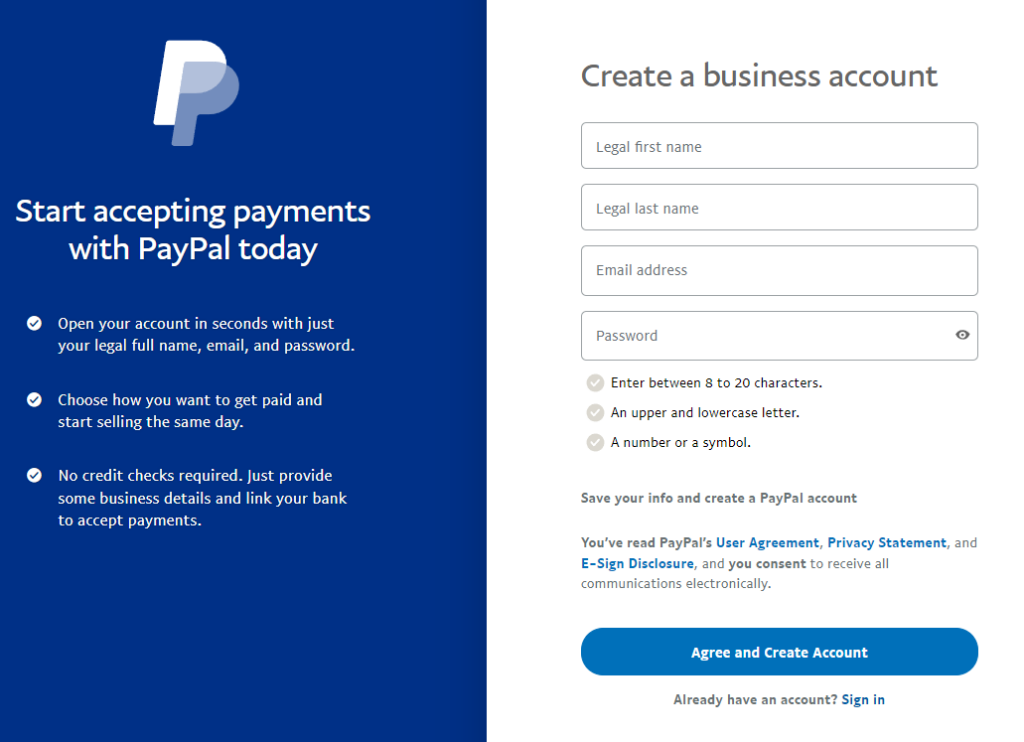

Step 1

Go to paypal.com/us/business and click the “Sign Up” button.

Step 2

Enter your personal information and create a password for your account.

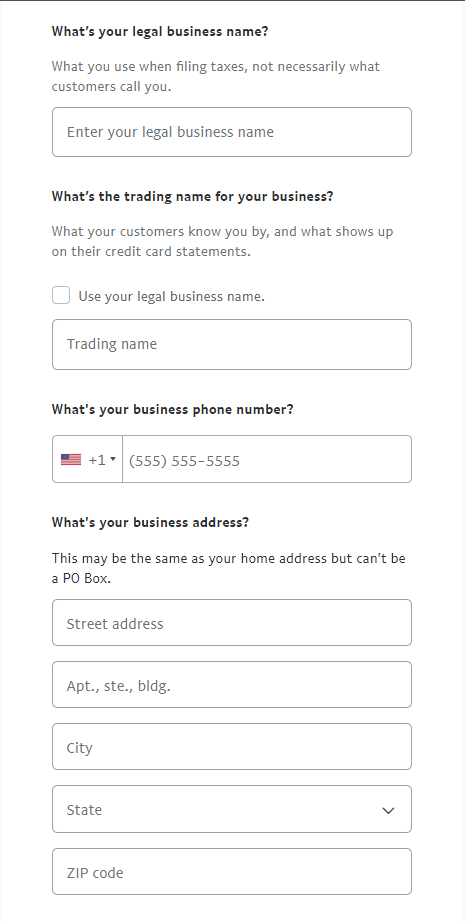

Step 3

Fill in all the information about your US LLC, including your legal business name, address, and phone number.

Step 4

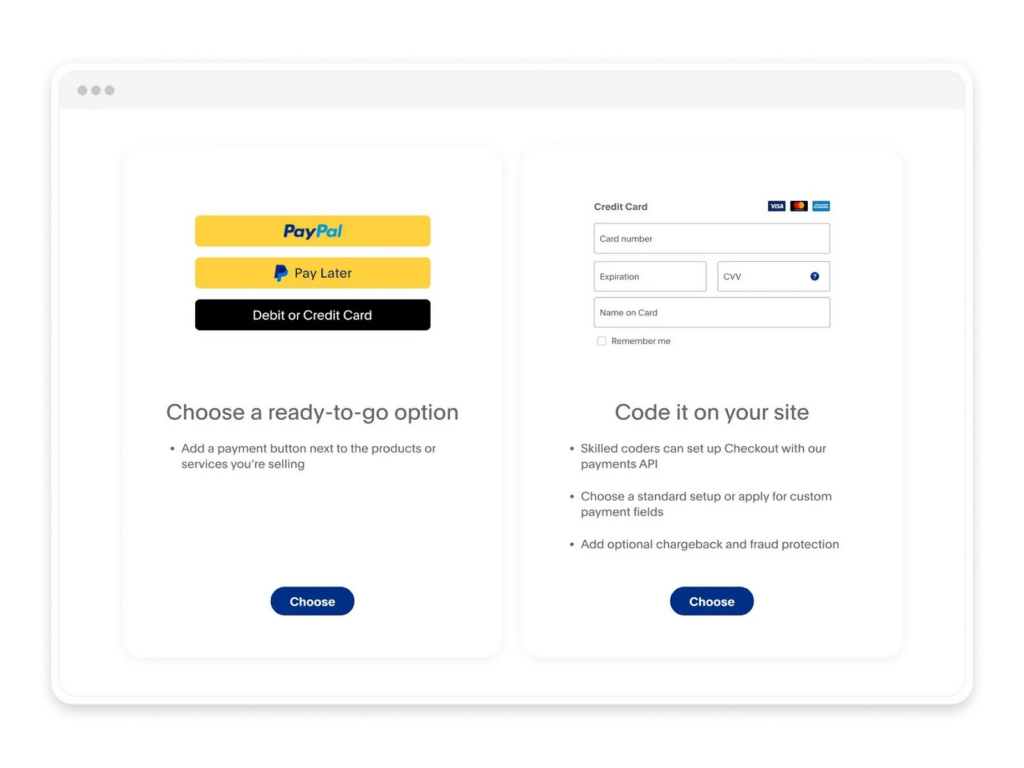

Connect your PayPal account to your US bank account and integrate it with one of the many supported platforms or content management systems (or code it on your website yourself using PayPal’s API).

NOTE: When PayPal asks for your Social Security Number, you can fill in your ITIN instead to open your account.

Is PayPal the Best Payment Option for Your Business?

Although PayPal is a versatile, secure, and user-friendly payment option for any type of business, there is one option that is always better — having a business bank account with a brick-and-mortar US bank.

PayPal allows you to integrate its payment system with various websites and services easily, but you don’t have as much control over your account as you would with a regular bank. The reason is that PayPal has its own terms and services you need to abide by and has the full right to terminate your account and seize your funds if you violate them.

However, integrating your business bank account takes time and effort since you must do it manually. But if you have the resources to do it, you’d get more control over your business’s payment processes than with PayPal.